26 Significant Budgeting Actions for Excessive Faculty College students

If we let college students graduate highschool with out studying key cash expertise like saving and budgeting, we’re doing them an actual disservice. These budgeting actions are terrific for a life-skills class, morning assembly dialogue, or advisory group unit. Give teenagers the information they should make sensible monetary decisions now and sooner or later!

FREE PRINTABLE

Free Printable Bean Price range Recreation Bundle

Seize this free printable worksheet bundle to assist your college students follow budgeting … in a world the place beans are forex! Within the first spherical, college students allocate their restricted beans to make decisions about their month-to-month price range and residing requirements. Then comes spherical two, the place life throws them a curveball and their price range turns into much more restricted. This sport is an interesting method to get college students desirous about budgeting with out having to fret concerning the nitty-gritty of {dollars} and cents.

Palms-On Budgeting Actions for Teenagers

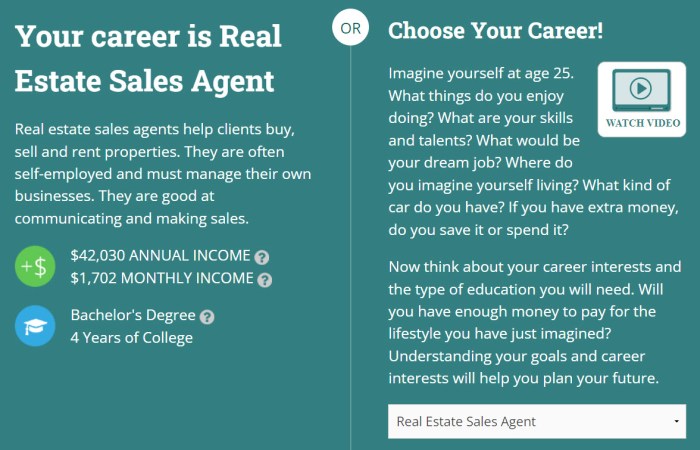

Introduce teenagers to sensible instruments for saving and budgeting, from planning worksheets and actions to sources to assist with monetary info and choices. Discover these collectively to assist college students perceive how cash works in the actual world, and what they’ll have to know to be accountable adults.

FEATURED PICK

Create a video about budgeting

Encourage your college students to make use of their voices to handle vital monetary well-being matters by way of The Edit, a digital storytelling problem from NBCU Academy and Adobe. This exercise empowers college students to create their very own 90-second video information reviews on monetary matters like budgeting, saving, and sensible spending. By exploring these ideas in a artistic format, college students not solely construct monetary literacy but additionally share their views in a significant approach. Plus, profitable lecture rooms earn prizes!

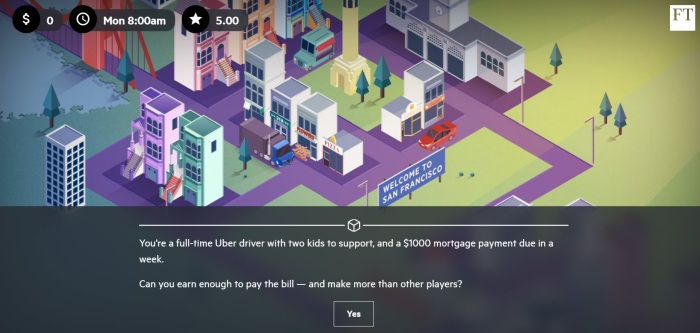

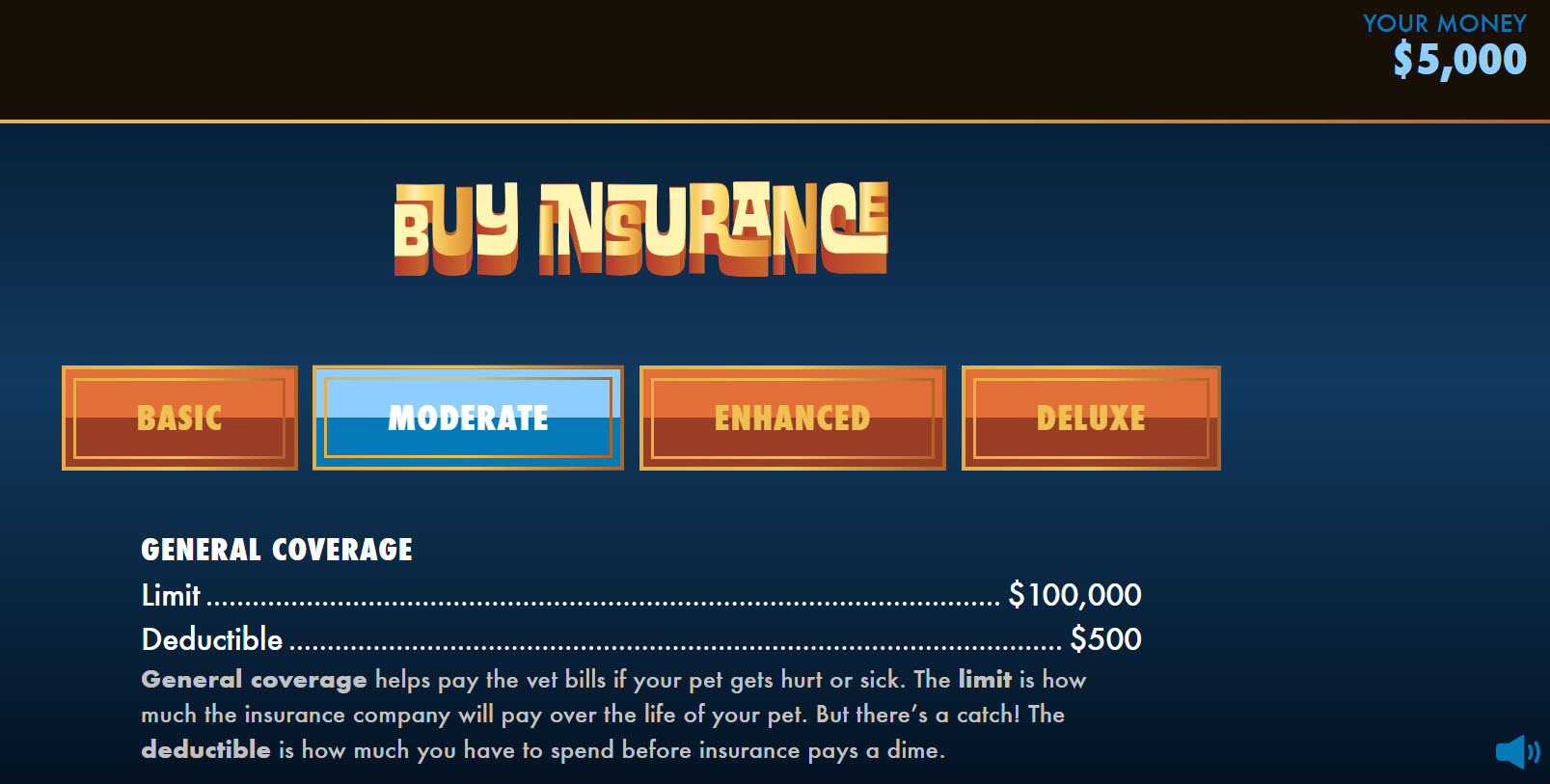

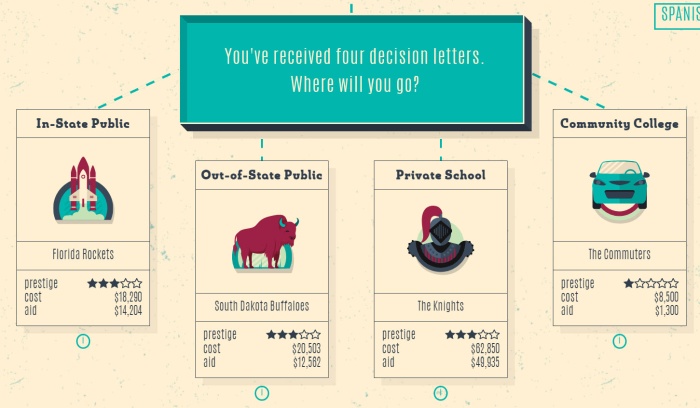

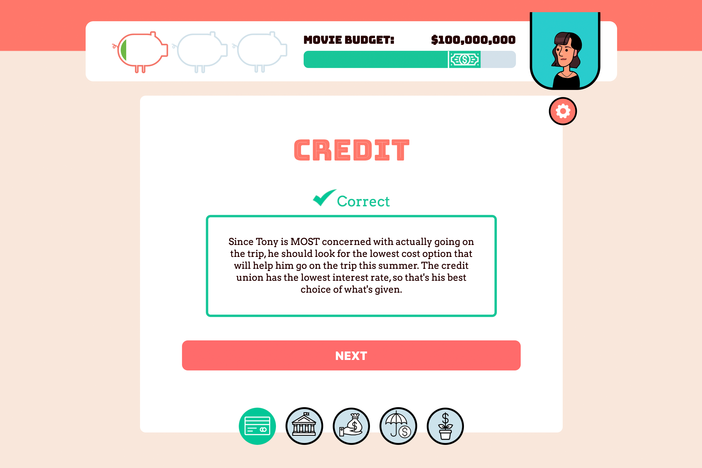

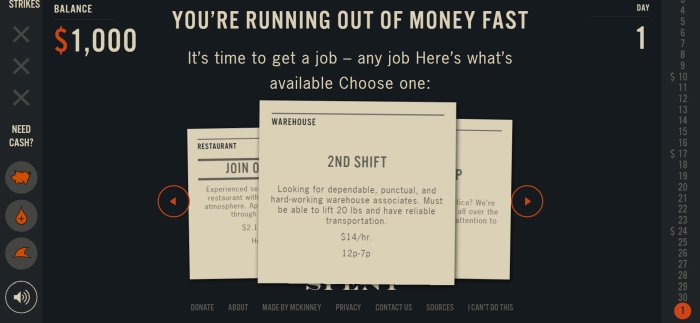

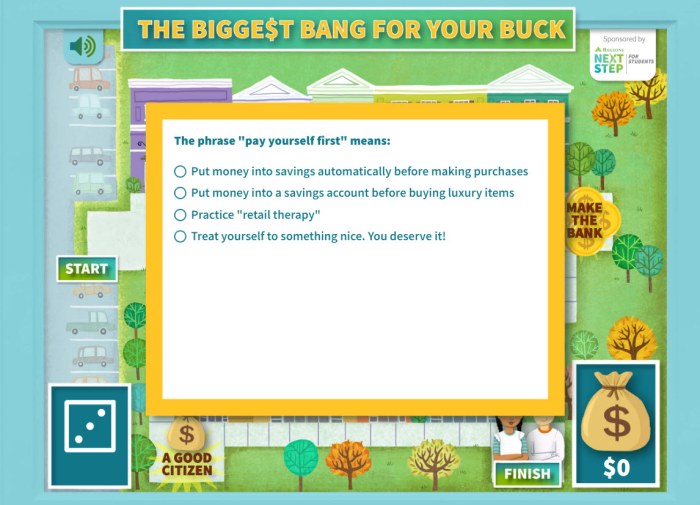

Free Interactive On-line Budgeting Exercise Video games

These on-line video games are a enjoyable method to get teenagers concerned within the ideas of incomes, saving, and budgeting their cash. Play them collectively as a category or in small teams. Or have college students play on their very own after which focus on or write about what they’ve discovered.