How Grammarly Constructed BEAM, an ML-Pushed Funds Allocation Software That Maximizes Advertising and marketing ROI

Parth Aidasani, Marina Adario, and Nitin Lakhara from Grammarly’s Information Science group co-wrote this text.

Grammarly’s ongoing funding in paid advertising and marketing has helped to develop our lively consumer base, making it an essential a part of Grammarly’s advertising and marketing technique. As we proceed to make use of paid acquisition channels to help our progress targets, we need to repeatedly consider our price range allocation throughout every channel. These efforts be sure that we preserve effectivity and scalability, permitting us to maximise the return on our advert funding.

To enhance how we allocate price range and guarantee we are able to repeatedly consider channel effectivity to tell price range selections, we constructed an AI-powered price range allocation framework. We designed this instrument to be self-serve in order that entrepreneurs and finance groups can use it to make price range selections based mostly on present knowledge alerts all year long.

On this publish, we’ll discover the method of constructing this instrument, stroll by means of how we used machine studying processes, and clarify the real-world issues of constructing such a instrument.

At this time’s price range allocation problem

At Grammarly, we’ve got a major advertising and marketing price range to allocate and 20+ channels to unfold it amongst. Our earlier price range allocation course of was prolonged, guide, and largely qualitative—leaning on area information. First-touch attribution knowledgeable many choices, which was deceptive due to its dependence on click-based monitoring and its tendency to miss many touchpoints within the client journey. Moreover, we made selections with out knowledge on how every channel’s effectivity varies with spending modifications, which restricted our understanding of channel-level price range modifications. These approaches typically led us to allocate price range to non-incremental channels, on account of counting on a conventional attribution mannequin and allocating price range to channels which are environment friendly however don’t scale.

We might see the large potential of optimum price range allocation on income, so we wished to maneuver to a extra environment friendly, data-driven, and ML-powered strategy. By constructing a knowledge product, we might empower our advertising and marketing group members to repeatedly consider price range allocations and make changes to maximise the return on our funding.

Introducing: BEAM

We created BEAM, Grammarly’s Funds Analysis and Allocation Supervisor. BEAM is a self-service instrument designed to allow our advertising and marketing and finance leaders to make data-driven price range allocation selections.

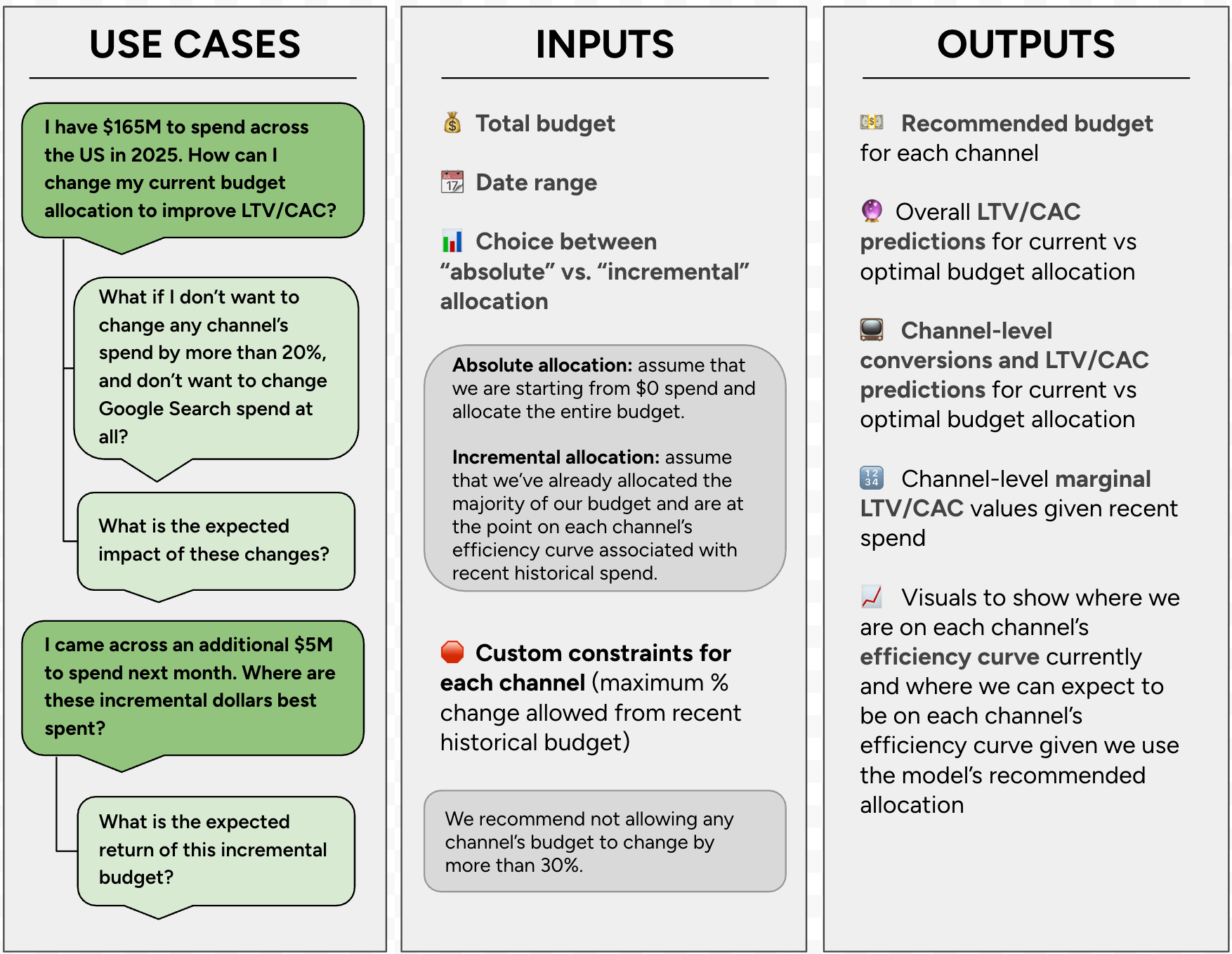

Software #1: Funds allocator instrument

BEAM’s major performance is as a price range allocator instrument. Customers can enter a complete price range and date vary, amongst different customized inputs, and the instrument will suggest the optimum allocation throughout channels.

LTV/CAC = Life Time Worth / Buyer Acquisition Value

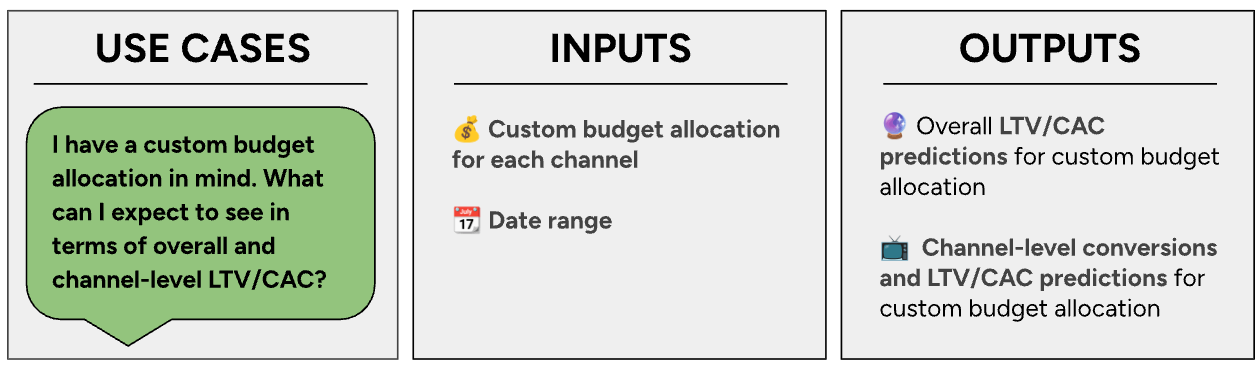

Software #2: Funds affect evaluation instrument

This instrument, much less continuously used however nonetheless impactful, permits customers to estimate the efficiency of particular price range allocations. Customers enter a customized price range allocation, and the instrument outputs the ensuing LTV/CAC they’ll count on, together with total and by channel.

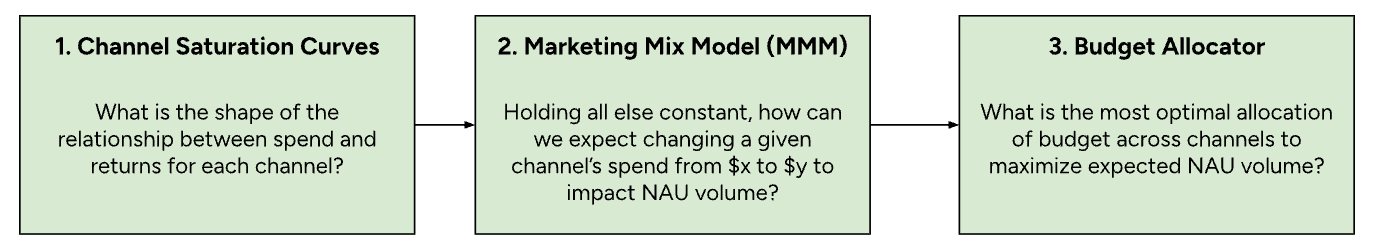

Methodology

Funds allocation as a constrained optimization downside

Consider price range allocation as a constrained optimization machine studying downside. We’ve a set complete price range by tier and need to maximize LTV by going after new customers who might carry within the highest potential worth.

To do that, we assign every new consumer an LTV worth based mostly on the nation and channel’s LTV per new consumer. We additionally add a constraint that limits spending so that every channel’s spend ought to change by not more than 30% from its current historic spend degree. This constraint ensures we keep away from making drastic modifications that threat harming advert platform efficiency and keep away from extrapolating mannequin outcomes exterior of the historic coaching knowledge vary. This quantity can range dynamically based mostly on every group’s threat urge for food.

For the sake of simplicity, let’s assume that we’ve got simply three advertising and marketing channels: Search, YouTube, and TV. The target perform and constraints for our optimization are as follows:

Goal perform

New Lively Customers = f(Search Spend, YouTube Spend, TV Spend)

Constraints

- Search Spend + YouTube Spend +TV Spend= Whole Funds

- (Prev Search Spend*0.7)<Search Spend <(Prev Search Spend *1.3)

- (Prev YouTube Spend* 0.7) <YouTube Spend <Prev YouTube Spend *1.3)

- (Prev TV Spend* 0.7) <TV Spend <Prev TV Spend *1.3)

This gives us with a place to begin.

Advertising and marketing Combine Mannequin (MMM)

Now, the onerous half: how will we outline f(Search Spend, YouTube Spend, TV Spend) ? Right here, we use a Advertising and marketing Combine Mannequin, or MMM. Particularly, we use a Bayesian MMM applied by way of pymc-marketing. This enables us to foretell weekly new lively consumer quantity as a perform of every channel’s spend together with seasonality and, optionally, different exterior variables.

We match:

NAUw = α + βSearch * ƒ(SearchSpendw) + βYouTube * ƒ(YouTubeSpendw) + βTV * ƒ(TVSpendw) + Sw + εw

the place NAUw is complete new lively consumer quantity in week w, and f({channel}Spendw) represents a change on every channel’s spend in week w. This consists of each advert inventory and saturation transformations (extra particulars on these later). Sw represents a seasonal part at week w, and w is a usually distributed error time period.

Let’s break down every part of the mannequin.

Intercept

The intercept time period is a fitted parameter that represents what number of new lively customers we’d count on to get in a median week with no advertising and marketing spend.

Seasonality part

We embody fitted seasonal elements into the mannequin to manage for seasonal results. Seasonal results, equivalent to Black Friday, can enormously affect new lively consumer quantity in a given week.

Advert-stock transformation

We don’t count on the whole affect of advert spend to be realized instantly, particularly for top-of-funnel channels like TV. To account for this, we embody a geometrical ad-stock transformation in our mannequin. The reworked spend worth in a given week is a weighted common of the present week’s spend together with the l prior weeks, which reduces the load of a given week as we go additional again in time. We let the mannequin match the variety of lagged weeks l together with the parameter , which defines the magnitude of decay over time.

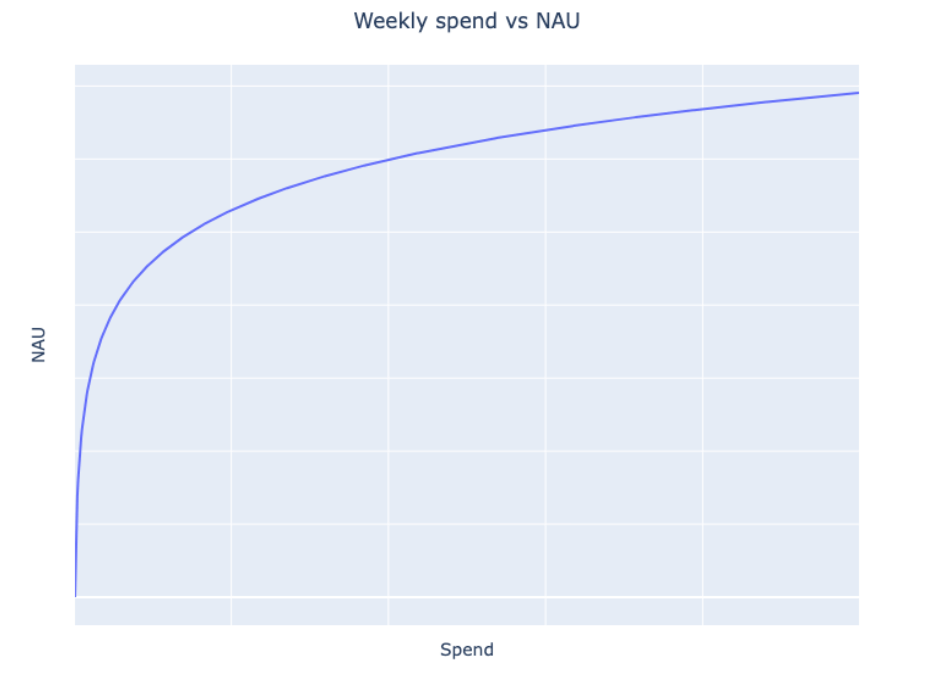

Saturation transformation

We all know that the connection between spend and returns will not be linear. As we spend extra, we see diminishing returns. In different phrases, every incremental greenback is much less precious than the final. We count on the connection between spend and new lively customers to comply with a form just like the one within the chart under:

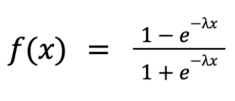

We use a logistic saturation transformation to measure the speed of diminishing returns. Particularly, we rework every channel’s spend utilizing the next:

We have to match one parameter , which represents the speed of saturation. For many of our channels, we’ve got attribution knowledge from the advert platforms that we are able to use to quantify the connection between spend and returns. We discover the worth of that most closely fits the advert platform knowledge and enter this worth as a previous into our closing MMM mannequin. Since we’re utilizing a Bayesian mannequin, we are able to enter priors for any of the parameters and permit the mannequin to study their optimum worth.

Again to the optimization downside

We’ve now match the MMM, which defines our goal perform:

New Lively Customers = ƒ(Search Spend, YouTube Spend, TV Spend)

Moreover, we contemplate the Life Time Worth (LTV) per new lively consumer as a result of every new consumer could have a unique predicted LTV based mostly on their demographics and product exercise. This permits us to optimize for a monetary-based consumer worth, not only a free consumer occasion.

We at the moment are prepared to unravel the constrained optimization downside. We use Sequential Least Squares Programming, or SLSQP (applied by way of scipy.optimize.reduce), to search out the optimum worth for every channel’s price range given this goal perform and our beforehand outlined constraints.

In brief, we are able to consider our price range allocation answer as having three separate components, every feeding into the subsequent.

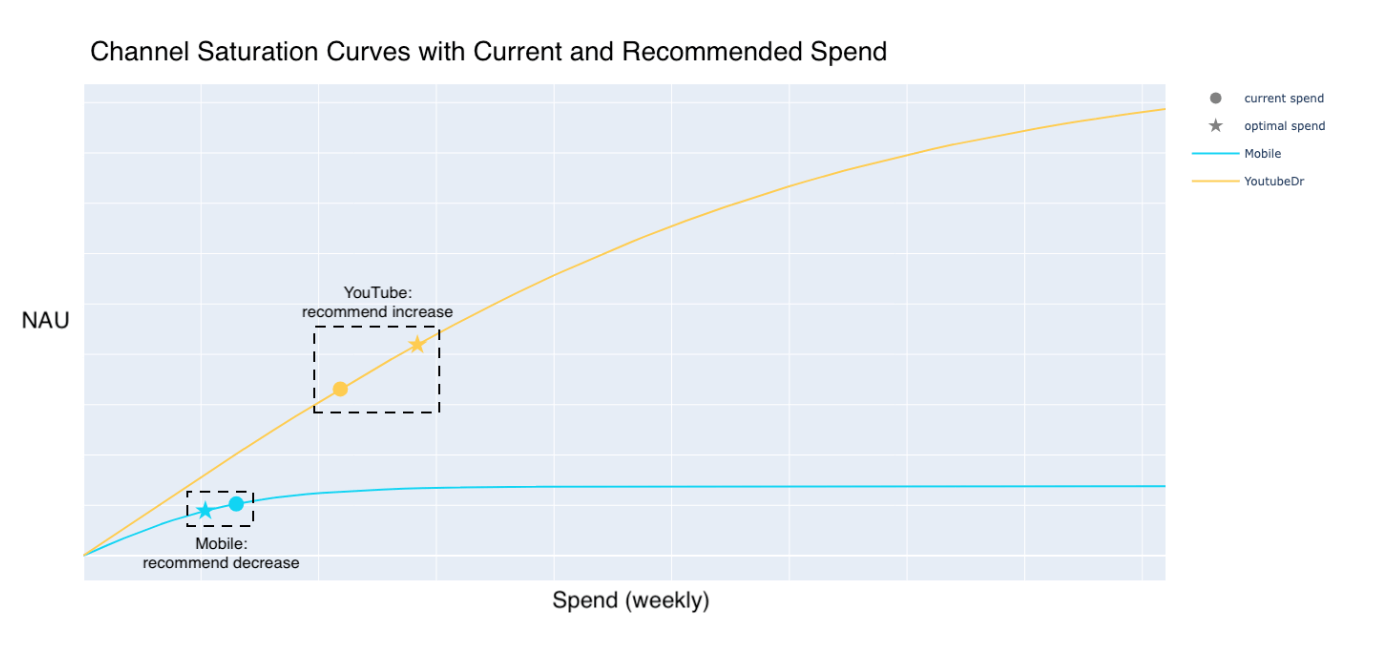

Trying into the black field

A key part of BEAM is giving customers visibility into why the mannequin is making its selections. We embody a sequence of charts that visualize the fitted relationship between spend and new lively customers, lifetime worth for every channel, and present versus advisable spend quantities. Beneath is a simplified instance of one in all these charts.

On this instance, present YouTube spend remains to be on an growing a part of the curve, implying that a rise in spend will result in a considerable enhance in new lively customers. Alternatively, for Cellular, present spend ranges are on the flatter a part of the curve, so the mannequin recommends reducing the price range since it may be extra effectively allotted elsewhere.

Present state vs. future state

Funds allocation has all the time been a essential problem in advertising and marketing, requiring groups to make data-driven selections about the place to speculate for optimum return, however typically with restricted or unreliable knowledge. Our journey from a guide attribution–based mostly strategy to a extra superior Advertising and marketing Combine Mannequin (MMM) that features automated optimization has considerably improved how we allocate budgets.

Previous state: Click on attribution–based mostly, advertisements platform knowledge, and guide allocation

Up to now, our advertising and marketing knowledge science group relied closely on deterministic attribution fashions. They primarily targeted on the first-click mannequin and a qualitative, heuristic-based understanding of our channels to allocate price range throughout them. This strategy had a number of limitations.

- Closely reliant on digital click on touchpoints: Our attribution mannequin primarily relied on click-based touchpoints, which severely underestimated the affect of our top-of-funnel/view-based channels, in addition to allocating all of the credit score to the primary interplay, ignoring the remainder of the touchpoints in a consumer’s journey.

- Guide decision-making: Funds allocation was an iterative course of, typically based mostly on historic traits, intestine intuition, and discussions between advertising and marketing and finance leaders.

- Lack of visibility into diminishing returns: There was no clear understanding of how elevated spend on a channel would possibly result in diminishing returns and at what level these diminishing returns made our advertising and marketing spend much less environment friendly.

- Elevated monitoring limitations: The expansion of on-line privateness measures has prompted important limitations throughout cookie knowledge, making it tough for advertising and marketing groups to attach advert exposures to conversions precisely.

Present state: Automated price range allocator

At this time, we use a Advertising and marketing Combine Mannequin to make price range allocation selections, fixing most of the limitations listed above. Our present state has additionally introduced a number of enhancements.

- Captures full-funnel and cross-channel results: MMM doesn’t depend on digital touchpoints, so it’s unaffected by attribution gaps. This enables the MMM to know the connection between spend and enterprise affect from channels throughout the funnel from TV to paid search, permitting us to check efficiencies throughout channels at totally different factors within the funnel.

- Accounts for long-term lag results: In contrast to attribution fashions, MMM considers the delayed affect of media buys, particularly these throughout video stock that won’t end in rapid motion.

- Incorporates spend elasticity: We now perceive how extra spend on a channel contributes to incremental features and at what level there are diminishing returns. This helps us higher reply “The place ought to we make investments our subsequent advertising and marketing greenback?”

- Automated price range optimization: By utilizing optimization capabilities, we are able to now make price range selections inside a matter of minutes, versus guide workout routines that would take weeks and intensive assets.

- Resilient to knowledge privateness modifications: Since MMM doesn’t depend on user-level monitoring, it stays unaffected by evolving privateness laws.

Analysis and validation

Whereas automation and MMM-driven price range allocation have a number of benefits, it is very important repeatedly consider and validate the mannequin and make suggestions to make sure it results in the anticipated outcomes. A few of these strategies embody:

- Backtesting with historic knowledge: Assessing the accuracy of our mannequin by making use of prior price range allocations and evaluating the predictions to precise efficiency.

- Holdout checks: Construct geo-based holdout checks the place one set of areas is utilizing the previous methodology’s price range allocation, and the second area is utilizing our present improved methodology. Collectively, these can measure the affect and carry of this new strategy.

- Conversion carry testing: Conversion carry/incrementality testing throughout every channel leveraged to validate the coefficients and MMM predictions.

- Calibration of priors: We calibrate our priors all year long by leveraging conversion carry checks. This not solely validates the MMM but additionally grounds its priors in knowledge, decreasing reliance on assumptions and historic biases. It ensures the mannequin displays incremental affect and adapts to altering effectiveness over time.

Closing ideas

As advertising and marketing continues to evolve, embracing superior measurement strategies might be key to staying forward in an more and more complicated and privacy-constrained panorama.

The transition from a guide attribution–based mostly strategy to an automatic, MMM-based strategy has made important strides in our price range allocation by utilizing superior attribution strategies, gathering extra insights by means of spend elasticity, and utilizing higher optimization capabilities—all of which result in way more correct price range suggestions in a fraction of the time. This enables us to maneuver previous resource-intensive duties, which included some guesswork, to a much more correct and scalable technique.

As well as, the self-serve instrument permits advertising and marketing and finance leaders to run price range allocation workout routines themselves, eradicating the necessity for lively help from the information science group.

In case you are excited in regards to the prospect of leveraging cutting-edge knowledge science to deal with challenges like advertising and marketing effectiveness, try our open positions and turn out to be part of our trailblazing journey.